Rumored Buzz on Clark Wealth Partners

Clark Wealth Partners Fundamentals Explained

Table of ContentsThe Facts About Clark Wealth Partners UncoveredNot known Facts About Clark Wealth PartnersUnknown Facts About Clark Wealth PartnersThe Definitive Guide to Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyNot known Incorrect Statements About Clark Wealth Partners What Does Clark Wealth Partners Mean?Not known Facts About Clark Wealth Partners

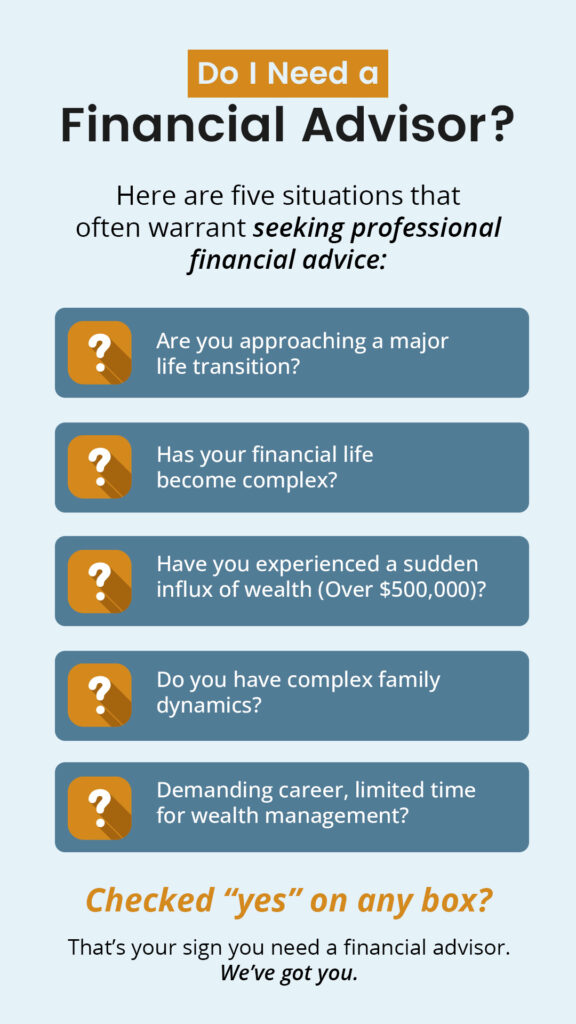

Common reasons to take into consideration an economic expert are: If your monetary situation has come to be more intricate, or you lack self-confidence in your money-managing skills. Saving or navigating major life events like marital relationship, divorce, kids, inheritance, or work change that might significantly influence your monetary situation. Browsing the shift from conserving for retired life to preserving riches throughout retired life and how to develop a solid retired life revenue plan.New technology has actually led to even more thorough automated monetary tools, like robo-advisors. It depends on you to check out and identify the ideal fit - https://telegra.ph/financial-advisors-illinois--Your-Path-to-Confident-Wealth-Building-Starts-Here-11-25. Ultimately, a great monetary expert should be as conscious of your investments as they are with their very own, avoiding too much fees, saving money on tax obligations, and being as transparent as feasible regarding your gains and losses

The Buzz on Clark Wealth Partners

Earning a commission on product referrals does not always imply your fee-based advisor functions against your ideal rate of interests. They might be extra likely to advise products and solutions on which they earn a compensation, which might or may not be in your best interest. A fiduciary is lawfully bound to put their client's rate of interests initially.

They might comply with a loosely monitored "viability" criterion if they're not signed up fiduciaries. This basic enables them to make suggestions for financial investments and solutions as long as they suit their client's objectives, danger tolerance, and economic circumstance. This can equate to suggestions that will also make them cash. On the various other hand, fiduciary experts are lawfully obligated to act in their client's finest passion instead of their very own.

Some Known Details About Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving right into complicated financial topics, clarifying lesser-known investment avenues, and uncovering ways visitors can work the system to their advantage. As a personal money expert in her 20s, Tessa is really conscious of the influences time and unpredictability have on your investment decisions.

It was a targeted ad, and it functioned. Find out more Review much less.

Not known Factual Statements About Clark Wealth Partners

There's no single path to coming to be one, with some individuals beginning in banking or insurance policy, while others start in bookkeeping. A four-year level supplies a strong structure for careers in financial investments, budgeting, and client solutions.

Facts About Clark Wealth Partners Revealed

Common instances consist of the FINRA Series 7 and Series 65 exams for protections, or a state-issued insurance policy certificate for marketing life or medical insurance. While credentials may not be legally needed for all preparing roles, employers and customers often see them as a benchmark of professionalism and reliability. We check out optional qualifications in the next section.

A lot of economic coordinators have 1-3 years of experience and knowledge with monetary items, conformity standards, and straight customer communication. A solid see here instructional history is important, yet experience shows the capacity to apply theory in real-world settings. Some programs incorporate both, allowing you to complete coursework while earning supervised hours through internships and practicums.

Rumored Buzz on Clark Wealth Partners

Several go into the field after operating in financial, audit, or insurance, and the shift calls for determination, networking, and commonly sophisticated credentials. Early years can bring lengthy hours, stress to build a client base, and the requirement to constantly show your experience. Still, the occupation uses strong lasting capacity. Financial planners appreciate the possibility to function closely with clients, overview vital life decisions, and frequently accomplish flexibility in timetables or self-employment.

Riches supervisors can raise their incomes via compensations, asset costs, and performance rewards. Monetary supervisors look after a team of financial coordinators and consultants, establishing department approach, managing conformity, budgeting, and directing internal operations. They spent much less time on the client-facing side of the industry. Virtually all economic managers hold a bachelor's degree, and many have an MBA or comparable academic degree.

The Only Guide to Clark Wealth Partners

Optional accreditations, such as the CFP, commonly need extra coursework and screening, which can extend the timeline by a pair of years. According to the Bureau of Labor Stats, personal economic advisors earn a typical yearly annual salary of $102,140, with top income earners earning over $239,000.

In various other provinces, there are guidelines that need them to fulfill certain demands to use the monetary expert or financial planner titles (financial advisor st. louis). What establishes some monetary consultants aside from others are education and learning, training, experience and credentials. There are many classifications for financial consultants. For financial planners, there are 3 common classifications: Qualified, Personal and Registered Financial Planner.

Some Known Details About Clark Wealth Partners

Where to find an economic advisor will certainly depend on the type of suggestions you require. These establishments have team who might assist you recognize and purchase certain kinds of financial investments.